Digital banks are shifting financial and banking operations into the online space, effectively integrating them into mobile devices. Digital wallets, which eliminate the need for physical cards and cash, allow users to securely store their funds and manage them quickly and conveniently from anywhere.

Today, more than half of the global population-4.4 billion people-use digital wallets. The annual volume of transactions processed through these platforms reaches 8-10 trillion dollars, growing at a rate of 18-22% per year. In Armenia, digital payments have already surpassed cash transactions, accounting for 52% of total payments.

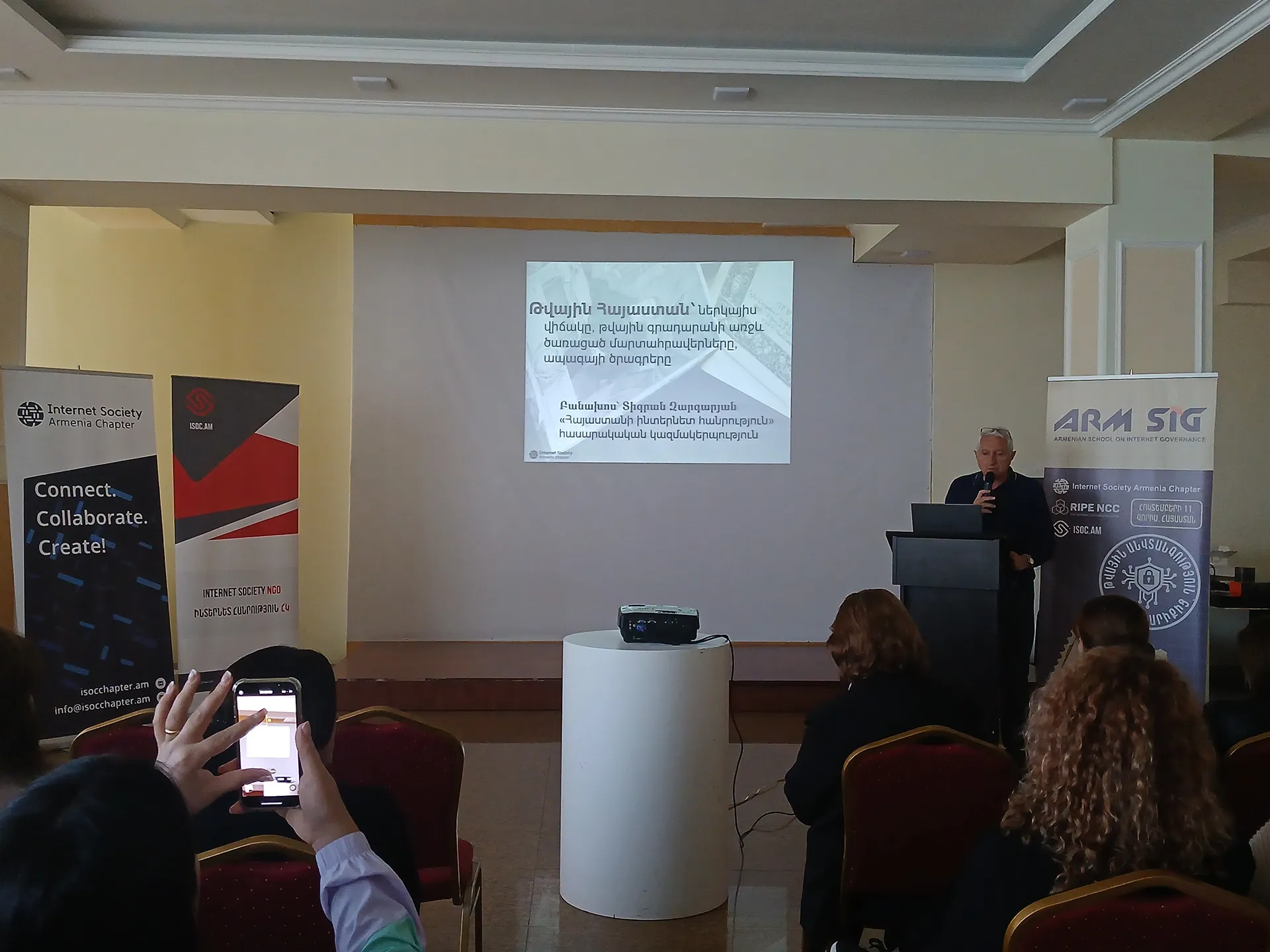

“A digital wallet allows users to store their cards, make payments using NFC and QR technologies, and transfer funds to other users. It is becoming the new standard for payments for more than half of the world,” noted Armen Virabyan, CFO of Easy Pay, while addressing approximately 70 participants at the Youth Internet Governance Forum Armenia (YouthIGF Armenia).

Discussing the risks associated with digital wallet adoption, Virabyan pointed to cybersecurity challenges, the limited engagement of older adults, and growing dependence on major technology platforms, among other concerns.

Nevertheless, ensuring the security of digital wallets requires not only strong systemic safeguards, but also responsible and attentive behavior from each user. This approach is essential to avoiding security breaches in the evolving digital financial landscape and preventing potential financial losses.